- Blue Chip Portfolios's Newsletter

- Posts

- 2026 Investment Themes and Model Portfolio Update

2026 Investment Themes and Model Portfolio Update

Each year beginning in December, and often lasting through early January, Wall Street strategists and pundits representing major banks and asset managers appear in the financial media to trumpet their views for the coming year. While these commentators often sound confident in their views on CNBC or in WSJ articles, the reality is that financial market predictions are very difficult. As a result, predictions tend to evolve based on the market moves themselves more so than actual conviction on the path ahead. The evolution of S&P 500 price targets throughout 2025 serves as an important anecdote to how this process typically works.

At the start of 2025, the Wall Street community was mostly positive on the market and the median S&P 500 price target called for an 11% gain for the year. By April 8, 2025 the S&P 500 had fallen by roughly 15% and the analyst community reacted by slashing price targets. Bank of America and Evercore, two of the most well respected firms on Wall Street, cut their S&P 500 price targets in April to 5,600 and 5,950 from 6,666 and 6,800 respectively. A number of other well known firms also cut their targets. As shown by the table below, after the market recovered most of its gains by August, these two firms and many others raised their S&P 500 targets in reaction to market gains. In contrast to this approach of mostly reacting to market moves and staying close to consensus, I published my view of how investors should react to the early year sell-off in my piece 5 Moves To Consider Amid Historic Stock Market Meltdown, which was published on April 6, 2025. The first point on that list was to consider buying the dip in U.S. equities which has worked out well thus far with the S&P 500 up roughly 38% since my piece was published.

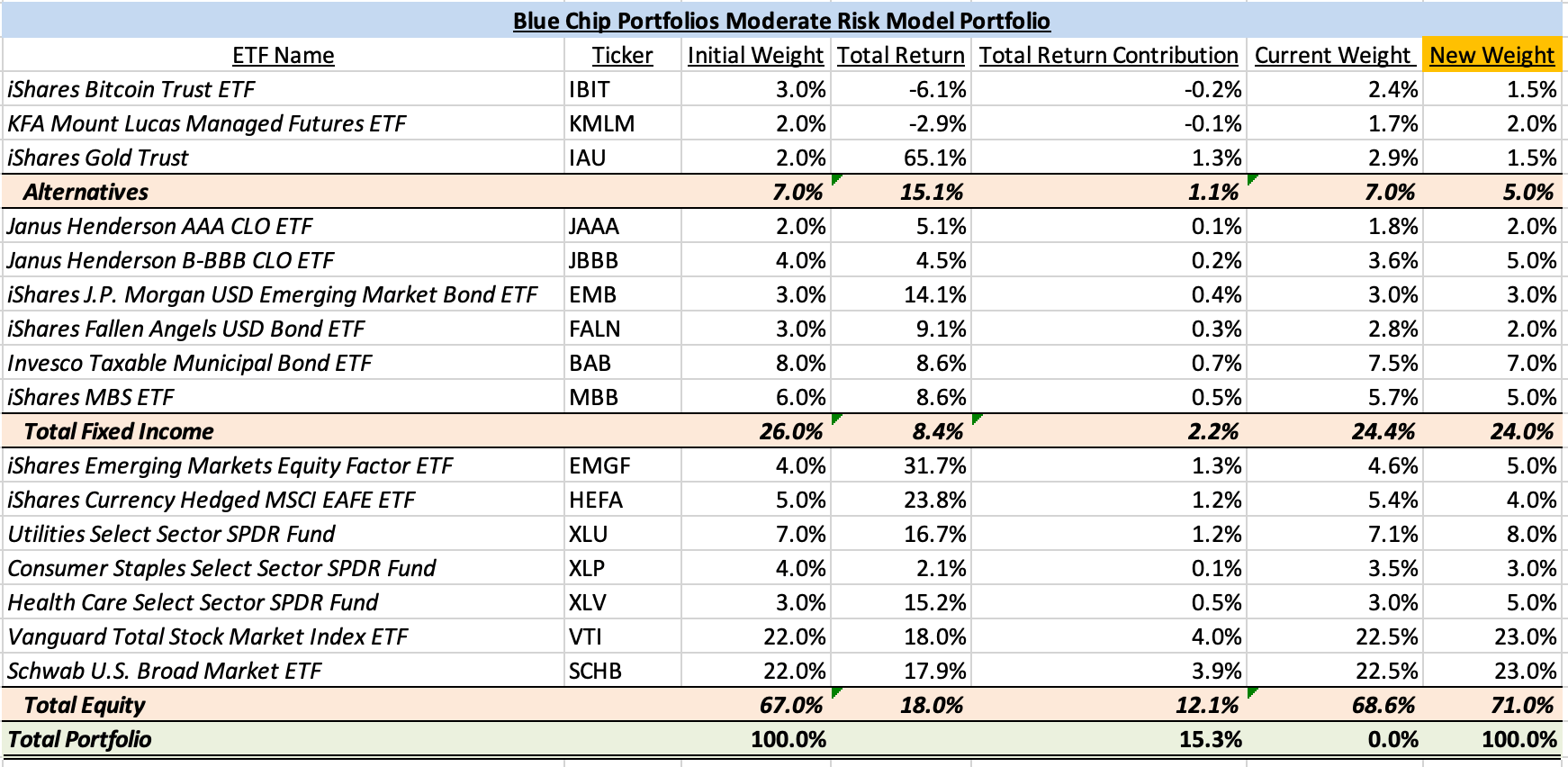

While I had conviction in standing against the crowd at that moment, I have less conviction right now in making bold macro bets and prefer to focus on portfolio construction. Against this backdrop, and a highly uncertain macro environment, my 2026 Investment Themes discussion will consider the opposing views to three key questions as we head into 2026. I will also share my approach to building a robust portfolio amid the uncertainty. Moreover, I will also discuss a few changes to the Blue Chip Portfolios Moderate Risk Model Portfolio which delivered a total return of 15.3% in 2025 compared to a 13.8% return for its benchmark, a traditional 60/40 portfolio. This follows performance of 18% for the model portfolio in 2024 compared to a 15.7% return for its benchmark.

Source: MarketWatch

Question 1: What to do with Gold?

Without question, one of the most surprising developments in 2025 was the surge in Gold prices. Gold rallied 65% in 2025 easily outperforming most other assets for the year. While Gold prices were helped by a weaker dollar, perhaps the most surprising thing is that the move occurred despite a fairly benign macroeconomic backdrop for risk assets. The dollar weakened but the U.S. dollar index registered only a single-digit percentage decline for the year. Fed rate cuts were also supportive but came in mostly inline with market expectations throughout the year. Moreover, inflation and inflation expectations (as measured by breakeven rates) remained fairly low.

The move higher in Gold was a key driver of strong outperformance for the Blue Chip Moderate Risk Model Portfolio in 2025 as the model portfolio started the year with a 2% allocation to Gold. The case for reducing or eliminating exposure to Gold is fairly straightforward: Gold prices have become detached from reality (i.e. other markets) and the recent move higher shows that Gold is not a defensive asset but rather a highly speculative investment that is not driven by fundamentals but rather investor sentiment. This argument resonates strongly with me (particularly the fact that other markets have not suggested a loss of confidence in the dollar or a spike in inflation is coming) and I would not be surprised to see Gold give back much of its 2025 gains as reality sets in. However, the counterargument is that Gold is the ultimate reflexive asset and higher prices actually lead to more demand as investors tend to get more interested in Gold investment following strong gains. Moreover, the case for including Gold in a portfolio is anchored by the fact that it has performed fairly well with a low correlation to other assets dating back to the 1970s. The recent move higher affirmed the bulls view that just because Gold is not a cash flow generating asset does not mean it does not have a role to play in a diversified portfolio.

Overall, my view is that taking some chips off the table makes sense given the extreme nature of the move but maintaining a modest position continues to make sense for portfolio construction reasons and diversification benefits. As such, I am reducing the Gold allocation in the Blue Chip Portfolios Moderate Risk Portfolio to 1.5% from 3% currently.

Question 2: What to do with Bitcoin?

One of my ideas that has not worked out as well as previously hoped has been my bullish view on Bitcoin. I noted my bullish view in my 2025 Investment Themes and Model Portfolio Update piece, published in early January 2025. Moreover, the Blue Chip Portfolios Moderate Risk Model portfolio also started the year with a 3% allocation to Bitcoin. While the macro economic backdrop has been favorable for Bitcoin, (risk assets have done well, the dollar has fallen, Fed has cut rates, and Gold has rallied sharply) the cryptocurrency has delivered a negative return of roughly 6%. Bitcoin’s poor relative performance has surprised me and I find it difficult to explain. Bitcoin ETFs have continued to grow in popularity and Bitcoin Treasury companies have continued to increase their holdings.

The bear case for Bitcoin is that if is not performing despite a strong fundamental backdrop then something must be wrong and perhaps we have reached peak Bitcoin. The bears argue that Bitcoin has no fundamental value, the rally has been purely speculative in nature, and recent underperformance is the first step in the unwind of a massive bubble. One possible explanation is that investors have recently shifted assets to Gold and AI driven stock bets. The bear case does not fully resonate with me as Bitcoin has historically experienced a high degree of volatility and had experienced a strong run up in prices prior to the start of 2025. The relatively weak performance in 2025 could simply be the rally taking a breather and early buyers deciding to take some profits by taking some chips off the table.

The bull case for Bitcoin continues to be the fact that it has delivered exceptionally strong historical performance and limited supply makes it a digital Gold of sorts which provides a valuable portfolio hedge. Continued investor adoption will lead to additional inflows which will drive prices higher over time. The fact that Bitcoin has experienced a lower correlation to equities and Gold this year is a positive in that it affirms that Bitcoin has solid diversification potential.

Overall, I remain a Bitcoin bull but am concerned with recent underperformance despite a strong fundamental backdrop. For this reason, I am reducing the Bitcoin weight in the model portfolio to 1.5% from 3% previously as my conviction has decreased as I struggle to explain recent underperformance. To the extent Bitcoin prices bounce back and make new highs in the future I would consider increasing exposure back closer to 3% in the future. Note that the 1.5% exposure is roughly what I consider to be a market weight exposure as outlined in my previous piece Should You Own Bitcoin?

Question 3: Stick with market cap weighted U.S. equities exposure or diversify?

It is no secret that the S&P 500 has become increasingly concentrated in its top holdings of late. The top five holdings in the S&P 500, Nvidia, Apple, Microsoft, Amazon, and Alphabet account for roughly 30% of the index’s total exposure. In addition to high concentration in terms of top holdings, the S&P 500 has also become increasing concentrated with regard to technology sector exposure. Right now, the technology sector accounts for roughly 34% of the index. Additionally, three key mega cap companies Alphabet, Meta Platforms, and Amazon technically are not included as part of the technology sector as Alphabet and Meta are classified as part of the communications services sector while Amazon is classified as part of the consumer discretionary sector. Inclusive of these three companies, the total weight of technology stocks in the S&P 500 increases by roughly 12% to a total of 46%. As a result, a key question facing investors is whether it makes sense to diversify or stick with a market cap weighted approach.

The case for diversification rests upon the idea that the S&P 500 has become much more concentrated than has been the case in recent history and thus the index is riskier than was previously the case as it is less diversified. Sectors which have traditionally offered diversification benefits such as Energy, Utilities, and Consumer Staples have now become a very small part of the index. Moreover, an increasingly high percentage of the market is dominated by the AI trade and at times the S&P 500 feels more like a bet on AI as opposed to a diversified bet on American business. The diversification maximalists argue that a highly concentrated portfolio stands in contrast to the basic idea of indexing which is to diversify bets across a wide selection of securities.

The case against diversification rests upon the idea that markets are highly efficient and thus any decision to deviate from a market cap weighted approach does not make sense as most other approaches involve higher fees and transaction costs. Additionally, the S&P 500 has done extremely well compared to nearly any other form of investing over the past decade. Diversifying equity bets such as hedge funds, private equity, small cap equities, international equities, dividend focused strategies, smart beta approaches, and sector bets (other than technology) generally have not added value to portfolios in recent memory. The case against buying a simple S&P 500 index is especially popular within the financial services community as asset managers and brokerages generally stand to benefit from investors allocating to anything other than a passive S&P 500 index given its low fee nature relative to other products. Alternative investment products routinely change investors 1% or more while active equity funds often have costs of 0.50% or higher compared to 0.03% for an S&P 500 index fund.

Despite increasing concentration in the S&P 500, I continue to believe market cap weighted indexes represent a compelling core exposure for any diversified portfolio. I am somewhat less swayed by the concentration arguments as the mega cap companies are exposed to different risks. For example, Nvidia the largest weight in the index currently is highly exposed to AI. However, one could make the argument that other top weights such as Apple and Alphabet actually stand to be hurt by advances in AI as it has potential to disrupt their existing businesses which enjoy very high degrees of profitability due to limited competition. For this reason, I think the index is more diversified than it seems by simply looking at the combined weight of its top holdings. That said, I do favor adding thoughtful additional exposures to produce a somewhat more diversified and less cyclical portfolio. As shown by the table below, the Blue Chip Portfolios Model Portfolio continues to hold healthy allocations to defensive sectors such as Utilities, Consumer Staples, and Healthcare. Additionally, the portfolio includes modest exposure to non-U.S. equities as well as small cap and mid cap exposure by virtue of owning U.S. total stock market index products instead of the S&P 500. I consider these diversifying exposures as thoughtful as they generally do not have high expenses and a significant chunk of the overweight to defensive equities serves as a replacement for fixed income assets which I see as offering minimal upside at current yields.

Model Portfolio Update

As shown by the table below, the Blue Chip Portfolios Moderate Risk Model Portfolio performed quite well in 2025 delivering a total return of 15.3% compared to 13.8% for its benchmark. Key drivers of outperformance in 2025 included a 2% allocation to Gold which rose 65% and an overweight exposure to Equities, including 9% exposure to international equities which outperformed U.S. equities this year.

As discussed earlier in this piece, key changes to the model portfolio for 2026 include a modest reduction in exposure to Bitcoin and Gold and a small increase in defensive equity exposure. I continue to view fixed income as fairly unattractive and the portfolio continues to be underweight fixed income relative to its benchmark. However, it is important to note that this underweight is not offset by on overweight exposure to U.S. market cap weighted equities rather it is offset by an overweight to defensive sectors such as Utilities, Consumer Staples, and Healthcare as well as alternatives such as trend following, Gold, and Bitcoin.

Thank you for reading. If you enjoyed this article and believe it was value additive please consider sharing it with friends or colleagues who you think may be interested and encouraging them to subscribe to the Blue Chip Portfolio’s Newsletter here: https://bluechipportfolios.beehiiv.com/

Questions, comments, or feedback? Please email us at [email protected]

Blue Chip Portfolios is a publisher of financial information and is not an investment advisor. Blue Chip Portfolios does not provide personalized or individualized investment advice. Information provided is not tailored to the needs of any particular recipient. Blue Chip Portfolios does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or advertiser.

THE INFORMATION ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. INFORMATION PUBLISHED ON THE SITE DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OR CONSIDERATIONS OF ANY INVESTMENT DECISION. INVESTORS SHOULD DO THEIR OWN RESEARCH AND MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN. INVESTORS SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN SITUATION BEFORE MAKING ANY INVESTMENT DECISIONS

No expression of opinion or statement, or any other matter herein, directly or indirectly, is a solicitation or offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned, or may have such a position in the future (and therefore may profit from movements in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will continue to maintain such positions.

Any projections, outlooks or estimates herein are forward looking projections and are thus inherently unreliable. They are based upon assumptions and should not be construed to be indicative of the actual events that will occur. Other events that have not been taken into account may occur and may significantly alter the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Blue Chip Portfolios undertakes no obligation to correct or update the information in this document or to otherwise provide any additional material.

Blue Chip Portfolios does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.