- Blue Chip Portfolios's Newsletter

- Posts

- 2025 Investment Themes and Model Portfolio Update

2025 Investment Themes and Model Portfolio Update

Capital market predictions are difficult. At the start of 2024, the median Wall Street analyst forecast for the closing level of the S&P 500 in 2024 was 5,000 while the highest forecast was 5,400. The S&P 500 ended 2024 at 5,881 or nearly 18% above the initial median Wall Street analyst forecast level.

The median Wall Street analyst forecast for the S&P 500 for 2025 currently stands at 6,600 which represents a roughly 11% increase from current levels.

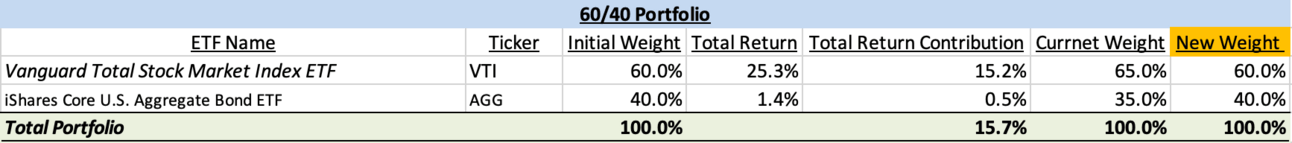

As was the case with my 2024 best ideas, my 2025 investment themes are intended to be focused on investment ideas which I believe can work in different market environments. The investment views discussed below also led me to make some changes to the Blue Chip Portfolios Moderate Risk Model Portfolio which has returned 18% since inception compared to 15.7% for its 60/40 benchmark portfolio .

Bullish on Bitcoin

I first discussed Bitcoin in my piece Should You Own Bitcoin? published in February 2024. In that piece I discussed both the bull case and bear case and explained the rationale behind the initial 1% Bitcoin allocation in the Blue Chip Portfolios Moderate Risk Model Portfolio. This allocation was a key driver of the model portfolio’s 2.3% outperformance to date compared to its benchmark (a traditional 60/40 portfolio.)

I believe the bullish case for Bitcoin has strengthened significantly from my prior piece for the following reasons:

The Trump administration is likely to provide a much more favorable regulatory background for Bitcoin than was previously the case.

There is now at least some probability that the U.S. Government establishes a Bitcoin reserve. While this may not be the base case outcome such an event would prove highly bullish for Bitcoin prices.

Increasing probability that U.S. states begin to establish their own Bitcoin reserves. Texas seems especially likely to move forward with some form of Bitcoin legislation as the state hosts much of the Bitcoin mining currently in the U.S. and is a Republican controlled state.

Increased institutional and retail investor adoption appears likely. BlackRock recently endorsed a 2% Bitcoin allocation as a “reasonable” allocation as a part of multi-asset portfolios. The wide availability of Bitcoin ETFs serves as a relatively frictionless way for institutional and retail investors to gain exposure which has only recently become available.

Bitcoin halving event in April 2024 has further reduced the supply of new Bitcoin which should be supportive of prices. Historically, Bitcoin halving events have proved very bullish for Bitcoin prices. The last halving event occurred in May 2020 and Bitcoin prices rose from ~$8,500 in May 2020 to ~$67,000 by November 2021.

Additional demand from buy and hold Bitcoin Treasury companies such as MicroStrategy. While MicroStrategy remains the largest and most successful player in the space other companies such as MARA Holdings have started to copy MicroStrategy’s approach by issuing convertible debt to buy Bitcoin. MicroStrategy now holds roughly $40 billion worth of Bitcoin and is likely to purchase significantly more Bitcoin in the coming year.

While I am highly bullish on Bitcoin in the near-term for the reasons noted above, this analysis would be incomplete if I did not note a key risk to my view which is an overall sell-off in risk assets. Bitcoin is a highly risky asset which tends to do well when risky assets such as equities are rising. Bitcoin could experience a significant decline if interest rates increase or the macro economic backdrop becomes more challenging. Overall, I continue to believe Bitcoin is somewhat asymmetrical in that it has the potential to rise to multiples of its current price but can only go to 0 on the downside. Given my positive view on Bitcoin, I have increased the Bitcoin allocation in the Blue Chip Portfolios model portfolio to 3%.

Bullish on Amazon

There are few companies that have the combination of competitive advantages and growth opportunities that Amazon (Ticker: AMZN) currently enjoys. As the leading cloud computing company and online retailer, AMZN enjoys key competitive advantages due to scale and early mover advantages that cannot easily be replicated by competitors. Moreover, AMZN is also gaining share in the search advertising business from Google. The company is uniquely positioned to benefit from a number of key secular trends: increased adoption of cloud computing vs on-premise computing, increased demand for cloud computing services due to AI training and usage needs, increased growth of online retail relative to physical retail, and a continued shift towards digital advertising away from traditional advertising.

Consensus earnings per share estimates currently call for AMZN to deliver earnings per share growth of 20%, 22%, 21%, and 18% respectively over the next four years. While the stock trades at an above market multiple of 36x forward earnings, I find it highly attractive given the strong growth profile. Comparably, Costco trades at 45x forward earnings but is only expected to grow earnings per share by ~10% over the next few years. Similarly, Walmart trades at 33x forward earnings and is expected to grow earnings per share by low double digit rates over the next year years. Another high quality benchmark company, Apple, trades at 33x forward earnings and is expected to grow earnings per share at a low double digit rate over the next few years.

Given the significant growth opportunities (both in terms of revenue growth and margin expansion) I think AMZN could surprise to the upside in terms of earnings growth over the next few years. Moreover, as the high quality nature of AMZN’s business becomes clear to the market I expect the stock’s valuation to re-rate higher from here.

(Full disclosure AMZN is the largest single stock position in my personal portfolio.)

Cautious on long maturity government bonds

While the yield curve has steepened over the past few months as the Fed has cut rates, I do not find the yield premium for long-maturity government bonds to be compelling. Currently, the U.S. 30yr yields 4.82% while the 10yr yields 4.60%. As shown by the chart below, the current spread of ~22bps compares to a 10 year average spread of 44bps.

I expect implementation of some aggressive fiscal expansionary policies from the Trump administration and growing national debt concerns could be a catalyst for a sell-off in longer-maturity government bonds in 2025. I believe the risk is skewed to the upside for 30year yields in the near-term while a move sharply lower in yields is fairly unlikely. Given this view, I have decided to eliminate exposure (down from a 7% initial weight) to long-maturity government bonds in the Blue Chip Portfolios moderate risk portfolio.

Source: Y Charts

Diversifying equity sector exposure is a good idea

While I remain broadly bullish on the AI investment theme and the large cap technology companies which have come to dominate the S&P 500 I believe adding some sector diversification to portfolios is prudent as the technology sector now accounts for more than 32% of the S&P 500 (when including Meta, Amazon, Netflix and Alphabet which are classified in sectors other than technology this number jumps to 44%.) I continue to view Utilities as an attractive diversifier to portfolios which get most of their risk from equities. Other sectors such as Consumer Staples, Energy, and Health Care, which have a relatively low weight in equity indexes and have defensive properties may provide diversification benefits in 2025.

I have decided to add a moderate allocation to the Consumer Staples sector and the Health Care sector as part of the model to increase sector diversification of the model portfolio’s equity exposure.

Model Portfolio Update

As shown by the tables below, the Blue Chip Portfolios Moderate Risk Model Portfolio has performed well thus far compared to its benchmark. The model portfolio has delivered a return of 18% compared to a return of 15.7% by a traditional 60/40 portfolio over the same time period.

One key driver of outperformance has been the model portfolio’s modest exposure to Bitcoin which contributed 1.2% to total portfolio performance due to the 124% gain in the iShares Bitcoin Trust ETF held in the portfolio. The model portfolio’s 3% allocation to Gold also was a key driver of outperformance as the IShares Gold Trust has delivered a total return of 28.5% resulting in a 0.9% to overall performance. Total return contributions from the model portfolio’s fixed income and equity holdings came in roughly inline with the benchmark portfolio though the model portfolio delivered slightly better results than the benchmark in both asset classes as an overweight to equity securities helped offset the drag from holding international equity exposure.

The “new weight” column below represents new model portfolio allocations while the “current weight” column represents the portfolio’s previous weight due to price movements as the portfolio had not been rebalanced. The most significant changes are the increase in Bitcoin exposure to 3% funded by reduced allocations to Gold and Managed Futures, the elimination of exposure to long-maturity bonds (Vanguard Extended Duration Treasury ETF EDV ) in favor of mortgage backed securities, and new allocations to the Consumer Staples and Health Care sectors funded by reduced allocations to broad based index ETFs VTI and SCHB.

While the model portfolio has some aggressive tilts (3% Bitcoin exposure, 67% total equity exposure) it also has some tilts (2% Gold, 2% Managed Futures, and 14% defensive equity exposure) which are likely to help in a more challenging market environment.

Thank you for reading. If you enjoyed this article and believe it was value additive please consider sharing it with friends or colleagues who you think may be interested and encouraging them to subscribe to the Blue Chip Portfolio’s Newsletter here: https://bluechipportfolios.beehiiv.com/

Questions, comments, or feedback? Please email us at [email protected]

Blue Chip Portfolios is a publisher of financial information and is not an investment advisor. Blue Chip Portfolios does not provide personalized or individualized investment advice. Information provided is not tailored to the needs of any particular recipient. Blue Chip Portfolios does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or advertiser.

THE INFORMATION ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. INFORMATION PUBLISHED ON THE SITE DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OR CONSIDERATIONS OF ANY INVESTMENT DECISION. INVESTORS SHOULD DO THEIR OWN RESEARCH AND MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN. INVESTORS SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN SITUATION BEFORE MAKING ANY INVESTMENT DECISIONS

No expression of opinion or statement, or any other matter herein, directly or indirectly, is a solicitation or offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned, or may have such a position in the future (and therefore may profit from movements in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will continue to maintain such positions.

Any projections, outlooks or estimates herein are forward looking projections and are thus inherently unreliable. They are based upon assumptions and should not be construed to be indicative of the actual events that will occur. Other events that have not been taken into account may occur and may significantly alter the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Blue Chip Portfolios undertakes no obligation to correct or update the information in this document or to otherwise provide any additional material.

Blue Chip Portfolios does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.