- Blue Chip Portfolios's Newsletter

- Posts

- Buybacks vs Dividends: 3 Things You Should Know

Buybacks vs Dividends: 3 Things You Should Know

There are two ways for companies to return capital to shareholders: dividends and share buybacks. There are a few things investors should know regarding key differences and potential investment implications.

1. Buybacks Tend To Be More Tax Efficient

Share buybacks tend to be more tax efficient for investors as buybacks allow for investments to be compounded on a tax deferred basis. The tax advantage is greatest for investors who are able to benefit from the step-up basis or investors who donate the appreciated shares to charity.

To better understand this advantage it is helpful to consider a simple example. Consider one of the highest yielding blue chip equities, Verizon (VZ), which currently carries a dividend yield of 7.1%. For investors who have owned the stock for more than 60 days, these dividends are generally considered qualified and are taxed at the same rate as long-term capital gains. Currently, the highest bracket tax rate is 20%.

Assuming an investor invested $100 in VZ at the start of a given year they will receive $7.1 in dividends which will be reinvested each year. Assuming the dividends are qualified our investor will owe $1.42 in taxes and receive net proceeds of $5.68. Assuming our investor invests this back into VZ stock the position will grow to $105.68 and our investor will have no capital gains (assuming the stock valuation is stable through time for purposes of this analysis.) The following year, our investor will receive dividends of $7.50 (7.1% of $105.68), owe tax of $1.50, and receive net proceeds of $6. Thus the total value of the position at the end of year 2 will be $111.68 and our investor will have no capital gains. In year 3, our investor would receive dividends of $7.92 (7.1% of $111.68), owe tax of $1.59, and receive net proceeds of $6.43. Thus the total value of the position at the end of year 3 will be $118.03 and our investor will have no unrealized capital gains.

Alternatively, let us assume that instead of paying a dividend VZ instead decided to return capital to shareholders via stock buybacks. Due to the 1% stock buyback excise tax, VZ would be able to return $7.03 via buybacks in the first year. Thus at the end of year 1, our investor will be holding a position worth $107.03 while sitting on an unrealized capital gain of $7.03. The following year, our investor will benefit from $7.52 worth of buybacks (7.03% of $107.03) and be left holding a position worth $114.55 with an unrealized capital gain of $14.55. In year 3, our investor will benefit from $8.05 worth of buybacks (7.03% of $114.55) and be left holding a position worth $122.6 with $22.6 in unrealized capital gains.

Assuming our investor under the share repurchase scenario decides to sell, $4.52 of tax will be owed and the investor will receive $118.08 in net proceeds. Comparably, our investor under the dividend scenario would receive $118.03 in net proceeds.

The $0.05 difference in outcomes is due to the fact that under the buyback scenario the investment is able to compound on a tax deferred basis. The difference in outcomes under these example scenarios would only continue to grow overtime.

In addition to the benefit of compounding on a tax deferred basis, some investors may be able to avoid paying any capital gains under the repurchase scenario if shares are held until death and passed on to heirs at a stepped up basis. Under this scenario the tax advantage relating to buybacks is much more significant as no tax will be paid under the repurchase scenario.

2. The Dividend vs Buyback Capital Allocation Decision Can Serve As An Important Signal For Investors

The dividend vs buyback decision for a company represents an important market signal that investors should pay attention to.

When a company decides to buyback shares it is sending a signal to the market that it believes its stock is undervalued relative to other investment opportunities that would be available to investors. On the other hand, a company that chooses to return capital to shareholders via dividends is sending a signal to market participants that the company believes investors would be better served investing in other investment opportunities.

It should also be noted that companies sometimes choose to focus on dividends or buybacks for other reasons. Some companies focus on dividend stability and growth as a way to showcase their stability. These companies are often known as dividend aristocrats. For example, consider Johnson & Johnson (JNJ) which recently announced its 61st consecutive year of dividend increases. Even if JNJ’s management team believed shares were highly undervalued, it is very unlikely that the company would choose to suspend its dividend to increase its share buyback program as that would tarnish the company’s dividend track record. On the flip side, companies with more volatile cash flows may prefer buybacks since repurchase programs can generally be paused without causing investor concern.

3. Companies with high buybacks have outperformed companies with high dividends on an absolute basis but not on a risk adjusted basis

In order to evaluate historical performance of companies focused on buybacks vs companies focused on dividends we can compare performance of two ETFs which have long histories: the Invesco Buyback Achievers ETF (PKW) and the Vanguard High Dividend Yield ETF (VYM). Both funds were launched in late 2006 and thus have a long historical track record.

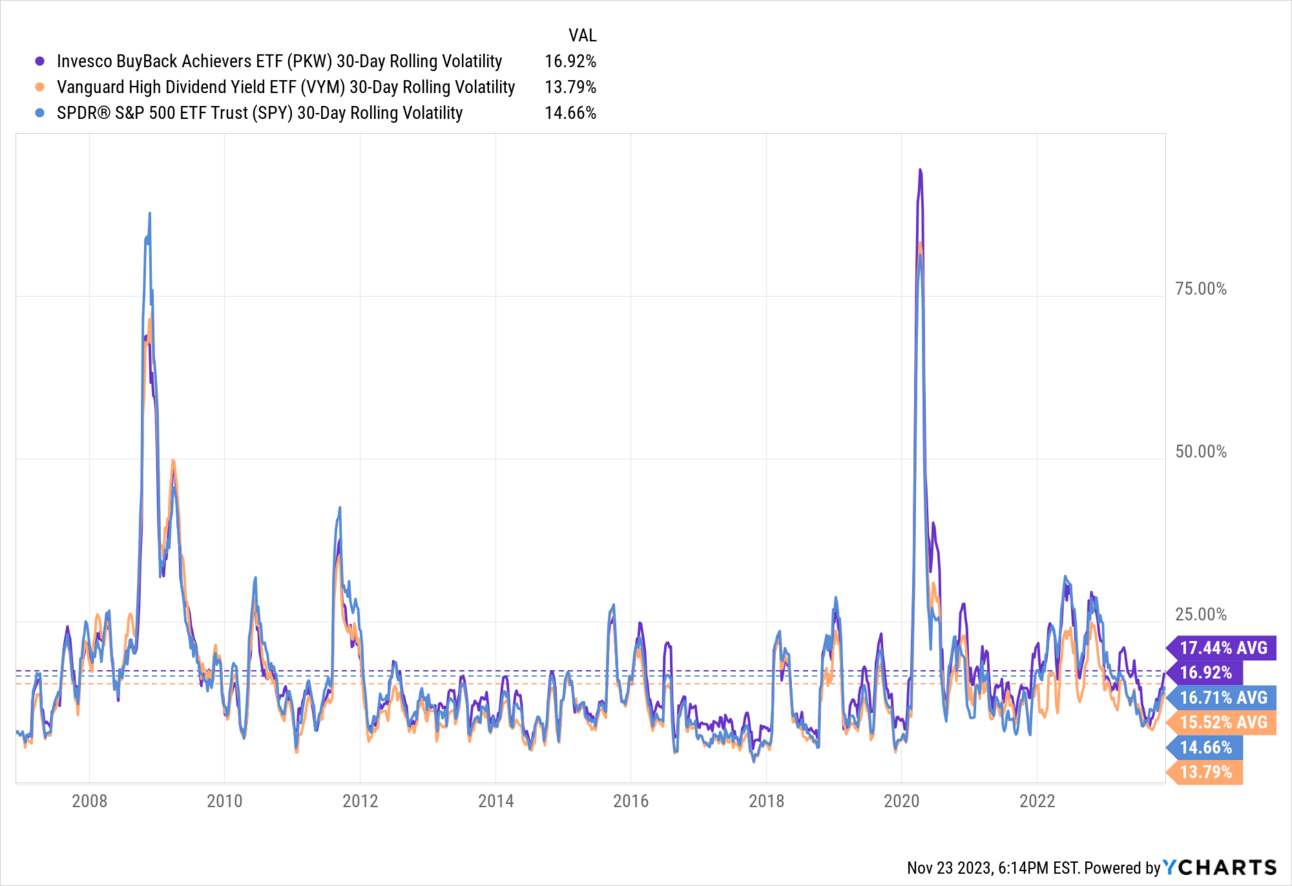

As shown by the chart below, PKW has significantly outperformed VYM since inception. However, PKW has done so with significantly more volatility. As shown by the chart below, since inception PKW has realized an average historical 30 day volatility of 17.4% compared to 15.5% for VYM and 16.7% for the S&P 500.

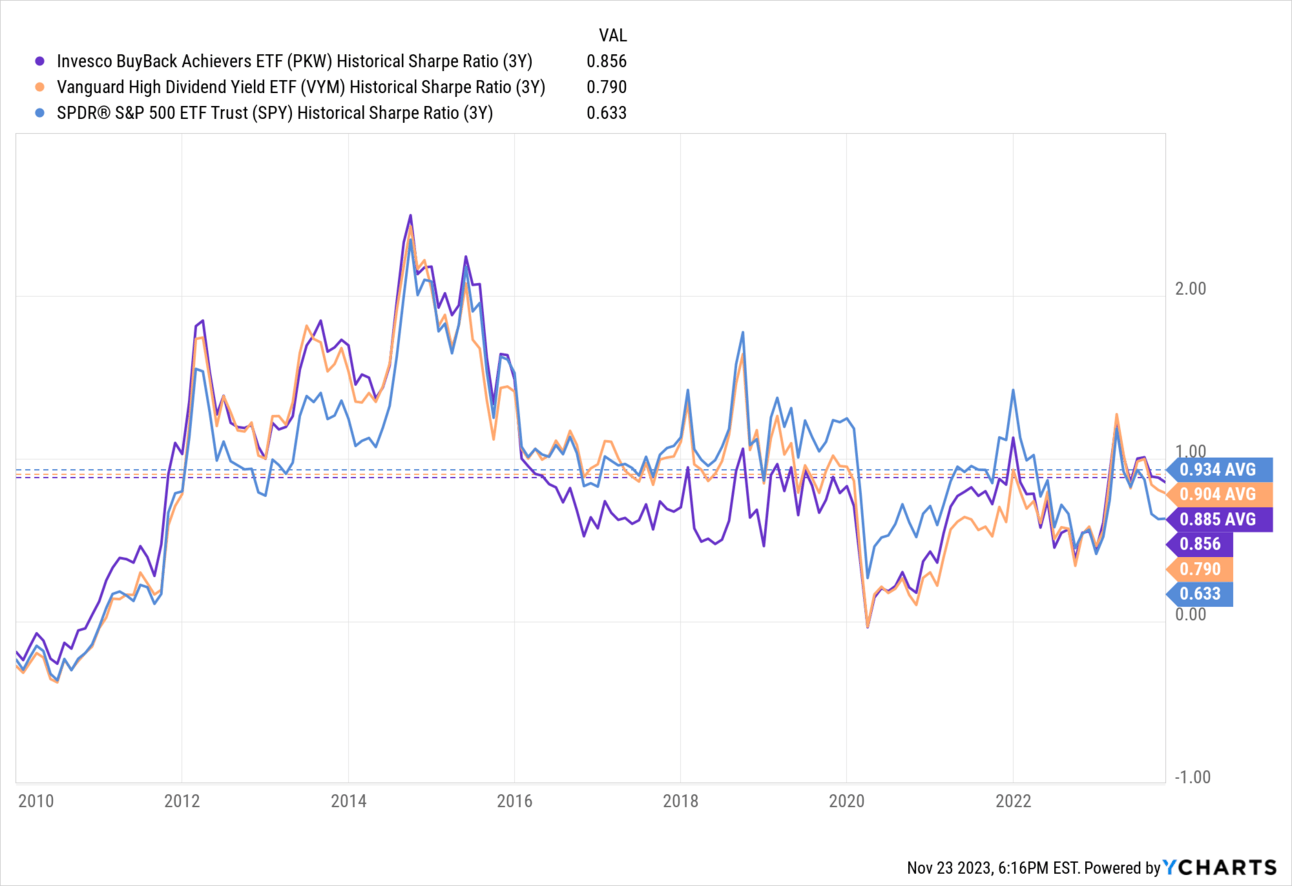

On a risk adjusted basis, PKW and VYM have performed almost the same with PKW realizing an average 3 year trailing sharpe ratio of 0.89 compared to 0.90 for VYM. The S&P 500 has realized a trailing sharpe ratio of 0.93 over the same time period.

Takeaways

Investors should carefully consider their personal investment objectives when building an investment portfolio. Investors may be able to optimize after tax results by focusing on asset location.

For investments made with a high likelihood of never being sold and thus benefiting from a step-up basis upon transfer, investments in companies with high buybacks may provide substantially better after tax returns compared to investments focused on high dividends.

For investments made with a limited risk tolerance and a high likelihood of sale, investments in dividend paying stocks may provide lower levels of volatility compared to investments focused on high buybacks.

For investments made with a short-term time horizon the difference in returns due to tax deferred compounding of returns is insignificant. However, for investments with long-term time horizons the benefits due to tax deferred compounding for investments focused on buybacks may be more attractive.

Investors who hold both dividend paying stocks such as VZ as well as buyback focused companies such as Berkshire Hathaway might be able to benefit from holding stocks such as VZ in tax advantaged accounts such as Roth IRAs as the investment will be able to compound tax free. Buyback focused companies such as Berkshire Hathaway might make more sense to hold outside of a retirement account so that investors may be able to benefit from a step-up basis and avoid paying taxes on gains.

While each investor will have an optimal strategy based on individual circumstances, investors can benefit from paying careful attention to dividend and buyback dynamics of an investment (ETF or stock). Optimal asset location and focus on investment objective can help drive significant tax savings and improve long-term outcomes for investors.

Thank you for reading. If you enjoyed this article and believe it was value additive please consider sharing it with friends or colleagues who you think may be interested and encouraging them to subscribe to the Blue Chip Portfolio’s Newsletter here: https://bluechipportfolios.beehiiv.com/

Blue Chip Portfolios is a publisher of financial information and is not an investment advisor. Blue Chip Portfolios does not provide personalized or individualized investment advice. Information provided is not tailored to the needs of any particular recipient. Blue Chip Portfolios does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or advertiser.

THE INFORMATION ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. INFORMATION PUBLISHED ON THE SITE DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OR CONSIDERATIONS OF ANY INVESTMENT DECISION. INVESTORS SHOULD DO THEIR OWN RESEARCH AND MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN. INVESTORS SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN SITUATION BEFORE MAKING ANY INVESTMENT DECISIONS

No expression of opinion or statement, or any other matter herein, directly or indirectly, is a solicitation or offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned, or may have such a position in the future (and therefore may profit from movements in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will continue to maintain such positions.

Any projections, outlooks or estimates herein are forward looking projections and are thus inherently unreliable. They are based upon assumptions and should not be construed to be indicative of the actual events that will occur. Other events that have not been taken into account may occur and may significantly alter the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Blue Chip Portfolios undertakes no obligation to correct or update the information in this document or to otherwise provide any additional material.

Blue Chip Portfolios does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.