- Blue Chip Portfolios's Newsletter

- Posts

- How To Beat A 60/40 Portfolio

How To Beat A 60/40 Portfolio

The idea of a 60/40 portfolio consisting of 60% equities and 40% fixed income was initially introduced by Nobel Laureate Harry Markowitz in 1952. Since then, the term “60/40” has remained an important part of the investment industry lexicon.

At its core, the insight that Markowitz developed was that investors could substantially reduce a portfolio’s risk by investing in different asset classes, capitalizations, industries, geographies, and return profiles. Markowitz’s Modern Portfolio Theory argues that any given investment’s risk and return characteristics should not be viewed alone but should be evaluated by how it affects the overall portfolio’s risk and return. Thus, investors can construct a portfolio of multiple assets that will result in greater returns without a higher level of risk.

The 60/40 approach has become quite popular as a moderate risk investing strategy. The strategy is very simple and can be implemented using a low cost mutual fund: The Vanguard Balance Index Fund (VBIAX). VBIAX invests 60% in a U.S. Total Market index, 40% in the U.S. Aggregate Float Adjusted Index, charges a net expense ratio of 0.07%, and has net assets of ~$50 billion.

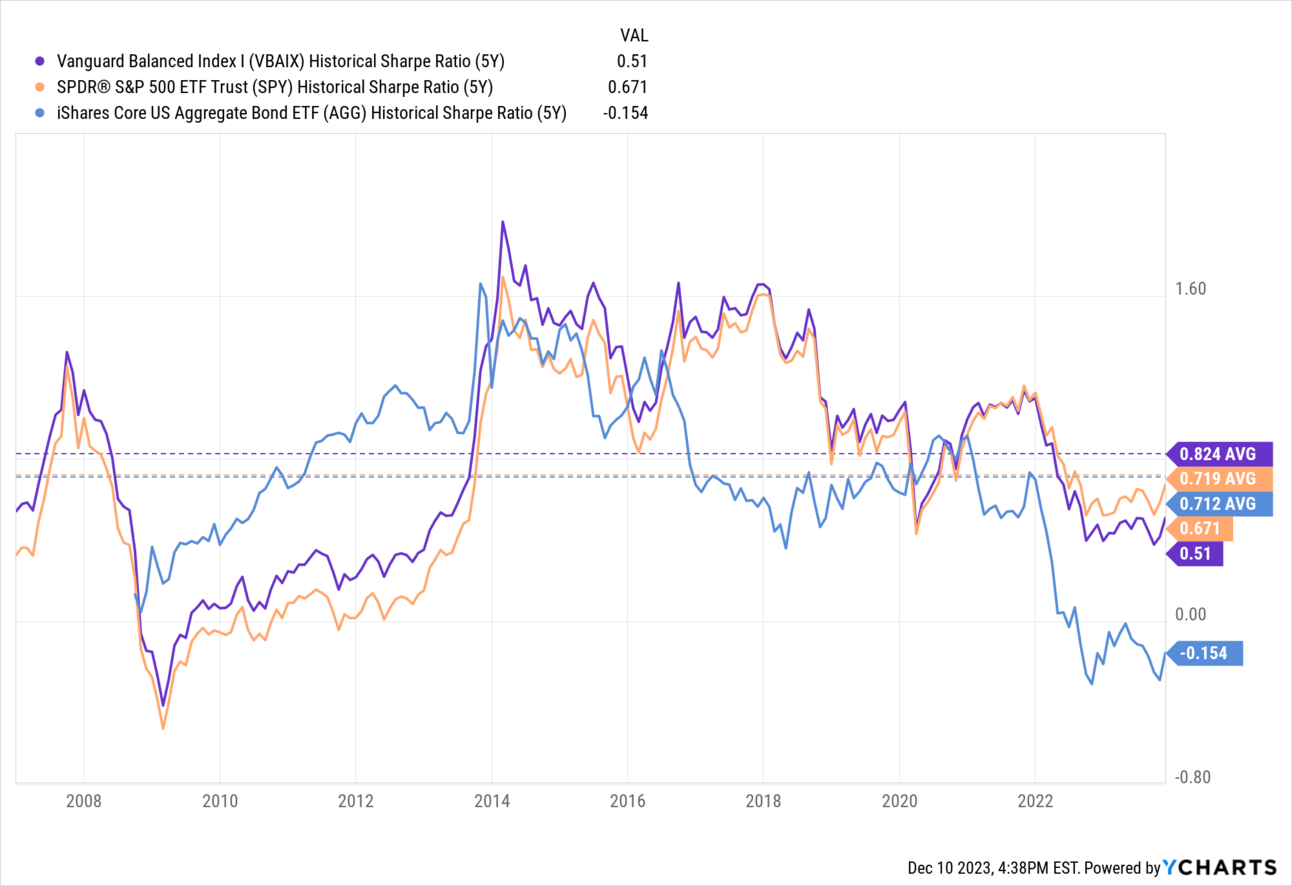

To get a sense of the appeal of the 60/40 portfolio and how modern portfolio management works consider the below chart which shows realized 5yr trailing sharpe ratios ( a metric of risk adjusted returns) of VBIAX, SPY (an ETF tracking the S&P 500), and AGG (an ETF tracking the Barclays U.S. Agg Bond Index).

Over the past 20 years, VBIAX has realized an average trailing 5 year sharpe ratio of 0.82 while SPY and AGG have realized average trailing 5 year sharpe ratios of 0.72 and 0.71 respectively. Thus, on a risk adjusted basis 60/40 has delivered a ~15% better risk adjusted return than an investment in either stocks or bonds would have delivered on its own. The reason for this is that high quality bonds and stocks do not typically exhibit a high degree of correlation on average (though there have been high correlation periods such as 2022) and thus a mix of these two assets produces better risk adjusted returns than has been possible holding one of these assets alone.

How To Beat A 60/40 Portfolio

Beating a low fee 60/40 portfolio on a risk adjusted basis is not an easy task. Below I will cover a number of potential strategies that can be employed in hopes of doing better than 60/40.

Market Timing

Market timing involves actively changing the mix of equities and bonds to attempt to time the market. Investors attempting this strategy would increase the equity component above 60% and correspondingly decrease the fixed income portion of their portfolio when they expect equities to perform well. This strategy can work, particularly if one is willing to be greedy when others are fearful, but market timing is very difficult as markets tend to be fairly efficient and predicting the macroeconomic environment is difficult.

Adding International Exposure

A basic 60/40 product such as VBIAX typically does not include international equity or fixed income exposure. Adding international equities and fixed income exposure is fairly easy as there are now many low cost ETF options available. The benefit to international exposure is that it serves as an additional diversification tool since global equity and fixed income markets across countries are not perfectly correlated. While international exposure is a reasonable idea it should be noted that investing legends Jack Bogle and Warren Buffett have both shunned international diversification.

Buffett has suggested that investors do not need international diversification as many large U.S. multinationals generate a significant portion of earnings from foreign markets. Excluding international exposure has been a good idea of late as U.S. equity markets have outperformed over the past 10, 5, 3, and 1 year trailing periods. However, that has not always been the case historically and it may change going forward. If the recent trend reverses investors will benefit from having some level of international diversification.

Individual Security Selection

Individual security selection is time consuming but may offer potential to improve upon 60/40 for sophisticated investors willing to dedicate sufficient time to researching individual stocks and bonds. While actively managed equity and fixed income products tend to underperform their benchmarks over long-periods of time, this is generally due to the high level of fees. Comparably, sophisticated individual investors may be able to manage an active portfolio at little or no additional cost vs using an index fund.

Adding Liquid Alternative Assets

In my post last week: Should You Own Managed Futures Funds? I discussed the potential benefits and challenges related to managed futures investments. Additional liquid alternative assets include hedge funds, long/short equity mutual funds and ETFs, commodities funds, volatility funds, tail hedge funds, merger arb funds, and others. These products tend to come with fairly high fees which can make it difficult for them to earn strong risk adjusted returns. However, a solid case can be made for including some of these assets if the correlation is low or negative with other assets in the portfolio.

Adding Illiquid Assets

Illiquid investments such as private equity and private credit were previously only available to institutional investors. However, that is beginning to change. For example, individual investors have a wide array of business development companies (“BDCs”) to choose from which offer exposure to private credit opportunities. Additionally, recently launched CLO products such as the Janus Henderson AAA CLO ETF (JAAA) allow individual investors to access securitized credit investments which tend to be less liquid. Illiquid assets are best held by investors who are unlikely to be forced sellers and thus will not need to liquidate during market stress events. If sized appropriately in the context of a portfolio, illiquid assets may have the potential to help investors improve upon a standard 60/40 portfolio.

Take More Credit Risk

The 40% of a typical 60/40 portfolio is normally invested in high quality bonds. For example, consider the fact that the iShares Core U.S. Aggregate Bond ETF (AGG) is primarily made up of government bonds and government backed mortgage securities. ~86.4% of AGG’s assets are invested in securities rated A or better and the fund has no exposure to securities rated below BBB. Thus, investors could add high yield bonds and investment grade corporate bonds as a replacement for exposure to AGG. However, the result of this will be that the bond portfolio will carry more credit risk and thus is likely to have a higher correlation to equities which may not improve the overall risk adjusted return of the portfolio.

Take More Interest Rate Risk

Typically the 40% of a 60/40 portfolio is invested in relatively short maturity bonds which carry limited interest rate risk. Currently, AGG has an effective duration of 6.15 years. Thus investors can expect to gain ~6.15% for a 100 bps decrease in interest rates. Investors can take more risk by adding longer maturity bonds to their portfolio instead of AGG.

For example, the iShares 20 Plus Year Treasury Bond ETF (TLT) has an effective duration of ~17 years. Alternatively, investors can increase duration by using levered products such as closed end funds or efficient ETFs such as the WisdomTree US Efficient Core Fund ETF (NTSX). The potential danger with adding interest rate risk is that sometimes interest rates and stocks move together. Moreover, long-maturity bonds tends to exhibit worse risk adjusted returns compared to short-maturity bonds.

Thank you for reading. If you enjoyed this article and believe it was value additive please consider sharing it with friends or colleagues who you think may be interested and encouraging them to subscribe to the Blue Chip Portfolio’s Newsletter here: https://bluechipportfolios.beehiiv.com/

Questions, comments, or feedback? Please email us at [email protected]

Blue Chip Portfolios is a publisher of financial information and is not an investment advisor. Blue Chip Portfolios does not provide personalized or individualized investment advice. Information provided is not tailored to the needs of any particular recipient. Blue Chip Portfolios does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or advertiser.

THE INFORMATION ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. INFORMATION PUBLISHED ON THE SITE DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OR CONSIDERATIONS OF ANY INVESTMENT DECISION. INVESTORS SHOULD DO THEIR OWN RESEARCH AND MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN. INVESTORS SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN SITUATION BEFORE MAKING ANY INVESTMENT DECISIONS

No expression of opinion or statement, or any other matter herein, directly or indirectly, is a solicitation or offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned, or may have such a position in the future (and therefore may profit from movements in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will continue to maintain such positions.

Any projections, outlooks or estimates herein are forward looking projections and are thus inherently unreliable. They are based upon assumptions and should not be construed to be indicative of the actual events that will occur. Other events that have not been taken into account may occur and may significantly alter the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Blue Chip Portfolios undertakes no obligation to correct or update the information in this document or to otherwise provide any additional material.

Blue Chip Portfolios does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.